The Jeevan Saral plan from LIC of India, also known as Plan 165, was a highly popular insurance plan with unique features that made it one of the most flexible conventional insurance plans available. While this plan is no longer available for purchase, existing policyholders can still enjoy the benefits it offers.

However, due to the specialized features of the Jeevan Saral plan, policyholders may find it challenging to fully understand its benefits. To help policyholders make informed decisions, the Jeevan Saral – Complete Calculator is available. This calculator can provide a comprehensive breakdown of the benefits offered by LIC’s Jeevan Saral plan, including information on maturity, insurance coverage, and surrender values.

The Jeevan Saral plan from LIC of India, also known as Plan 165, is a unique insurance plan with several key features that set it apart from other endowment plans. These features include:

- Flexible premium payment: Policyholders can choose their own premium amount and the Maturity Sum Assured, which determines the Death Sum Assured, is subsequently determined based on the premium selected.

- Death coverage: In case of the policyholder’s death, the Death Sum Assured will be the sum of 250 times the monthly basic premium, the premium paid (excluding the first-year premium and rider premiums), and any Loyalty Additions.

- Maturity amount: The Maturity Sum Assured, which varies based on the age at entry and term of the plan, plus any Loyalty Additions, will be paid out as the maturity amount.

- Surrender option: Policyholders can choose to surrender the plan completely or partially any time after 3 years, provided premiums have been paid for at least three full years.

- Auto cover: If the policy has been in force for 3 or more full years, auto cover will be available for a period of 12 months. However, this will not be applicable for rider benefits.

- Rider benefits: Term Rider and Accident Benefit Rider are available based on certain conditions and restrictions.

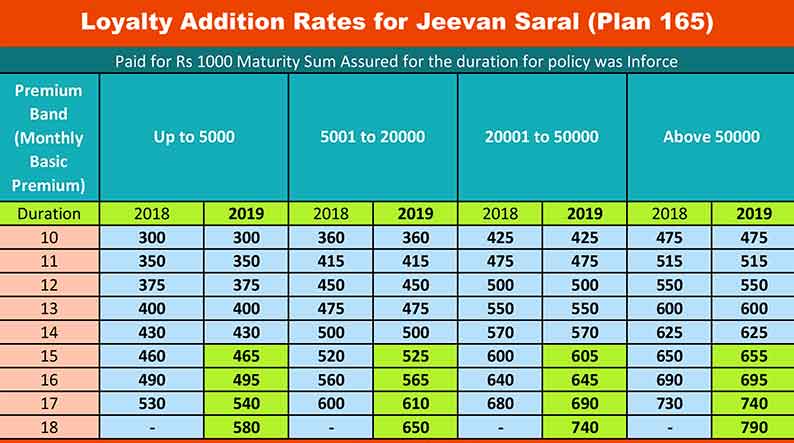

Loyalty Addition Rates of LIC Jeevan Saral

The Loyalty Addition Rates for the Jeevan Saral Plan have been declared by LIC for up to 18 years of term. These rates are used to calculate the maturity and death benefits for policyholders.

However, as the plan is no longer available for purchase, to estimate the loyalty addition rates beyond 18 years, extrapolation was used using the ‘trends’ function. It’s important to note that the calculated rates obtained through extrapolation are not guaranteed and are only used to provide an indicative figure.

Policyholders are advised to consult with LIC or lic agent for more accurate and up-to-date information on Loyalty Addition Rates for the Jeevan Saral Plan.

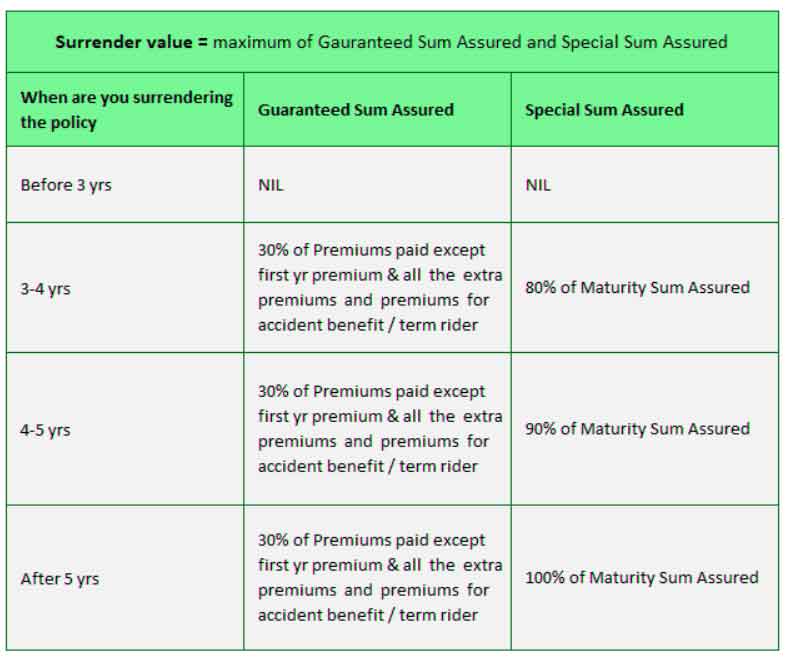

Surrender Benefit :

Upon surrendering LIC Jeevan saral policy, a benefit can be availed, namely the guaranteed surrender value of the policy. However, this can only be obtained if the policy has completed a minimum of three years. It’s important to note that once the policyholder receives the surrender value, the policy will be terminated and no further benefits can be claimed from it.

Survival Benefit – How much will I get on the Maturity of Jeevan Saral policy?

At the end of the policy term , the policyholder will be entitled to receive the following benefits:

- Sum Assured

- Loyalty Additions (if any)