LIC Jeevan Akshay VII is the latest version of the Immediate Annuity plan offered by Life Insurance Corporation of India (LIC). It is a non-linked, non-participating, single premium annuity plan that provides regular income to the policyholder throughout their lifetime. The plan is purchased by paying a lump sum amount at the time of entry, and the annuity payments start immediately after that.

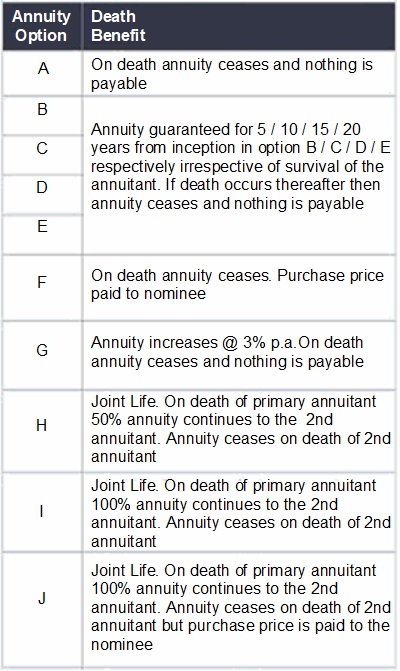

LIC Jeevan Akshay VII offers multiple annuity options to choose from, including:

Annuity for life: The annuity payments are made to the policyholder throughout their lifetime.

Annuity guaranteed for a certain period: The annuity payments are made for a specified period of 5, 10, 15, or 20 years, regardless of whether the policyholder survives or not. If the policyholder dies during the guaranteed period, the annuity payments will continue to be paid to the nominee.

Annuity with return of purchase price: The annuity payments are made throughout the lifetime of the policyholder, and on their death, the purchase price is returned to the nominee.

Joint life annuity: The annuity payments are made to the policyholder and their spouse throughout their lifetime. After the death of both policyholders, the purchase price is returned to the nominee.

Joint life annuity with return of purchase price: The annuity payments are made to the policyholder and their spouse throughout their lifetime, and on the death of both policyholders, the purchase price is returned to the nominee.

Annuity for life with increasing income: The annuity payments increase at a rate of 3% or 5% per annum, compounded annually.

The policyholder can choose any of the above options based on their requirements and preferences. The annuity rates are based on the age and gender of the policyholder, and the annuity option selected. The plan offers tax benefits under Section 80CCC of the Income Tax Act, 1961.

LIC Jeevan Akshay Plan offers several benefits, including:

Guaranteed regular income: The plan provides a regular and guaranteed income in the form of annuity payments to the policyholder throughout their lifetime, ensuring financial security and stability.

Multiple annuity options: The plan offers multiple annuity options to choose from based on the policyholder’s requirements and preferences.

Immediate annuity: The plan offers an immediate annuity, where the annuity payments start immediately after the lump sum payment is made, ensuring that the policyholder receives regular income without any delay.

No medical examination required: The plan does not require any medical examination or health check-up, making it easy to purchase.

Tax benefits: The premiums paid under the plan are eligible for tax benefits under Section 80CCC of the Income Tax Act, 1961.

Option to cover spouse: The plan offers a joint life annuity option, where the policyholder can choose to cover their spouse and ensure that they receive regular income even after the policyholder’s death.

No market risk: The plan is a non-linked, non-participating plan, which means that there is no market risk involved, and the policyholder’s income is not dependent on market fluctuations.

Death benefit: Some annuity options under the plan provide a death benefit, where the purchase price is returned to the nominee in case of the policyholder’s death, ensuring that the policyholder’s family is financially protected.

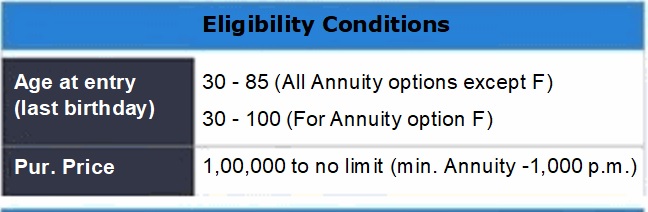

The eligibility criteria for LIC Jeevan Akshay Plan are as follows:

Minimum age: The policyholder should be at least 25 years old to purchase the plan.

Maximum age: There is no maximum age limit to purchase the plan, but the annuity rates may vary based on the age of the policyholder.

Premium payment: The plan is a single premium plan, which means that the policyholder needs to make a lump sum payment at the time of entry.

Annuity payment frequency: The policyholder can choose to receive the annuity payments monthly, quarterly, half-yearly, or annually.

Annuity options: The policyholder can choose from multiple annuity options offered under the plan.

Sum assured: The sum assured under the plan depends on the premium paid by the policyholder and the annuity option chosen.

Medical examination: The plan does not require any medical examination or health check-up.

Policy term: The policy term is for the policyholder’s lifetime, and the annuity payments continue until the policyholder’s death.

It is important to note that the eligibility criteria may vary based on the specific annuity option chosen by the policyholder.

Tax Benefits in LIC Jeevan Akshay VII

LIC Jeevan Akshay VII offers tax benefits under Section 80CCC of the Income Tax Act, 1961. The premiums paid under the plan are eligible for tax deductions up to a maximum limit of Rs. 1.5 lakhs per year under Section 80CCC, subject to certain conditions. The tax benefits are available for both individual and Hindu Undivided Family (HUF) taxpayers.

The annuity payments received under the plan are taxable as income in the hands of the policyholder in the year in which they are received. The tax is levied at the applicable slab rate of the policyholder, depending on their income.

It is important to note that the tax laws are subject to change from time to time, and the policyholder should consult a tax advisor for detailed information on the tax implications of the plan based on their specific circumstances.

An Example

The LIC Jeevan Akshay VII policy has been purchased by Mr. Roy in March 2023 , a 50-year-old working professional. He has paid a purchase price of Rs. 15,00,000 plus GST for the policy. The policy offers various annuity options and rates to choose from, which are listed below.

Scenario 1 :

Age : 50 years – Single life

Purchase Price – ₹ 15 Lakh + GST

Annuity Mode – Yearly

| Annuity Option | Annuity Amount ₹ |

| A | ₹ 1,17,000 per year |

| B | ₹ 1,16,700 per year |

| C | ₹ 1,15,950 per year |

| D | ₹ 1,14,900 per year |

| E | ₹ 1,13,250 per year |

| F | ₹ 97,650 per year |

| G | ₹ 90,600 per year |

Scenario 2:

Age : 50 years – Single life

Purchase Price – ₹ 15 Lakh + GST

Annuity Mode – Half Yearly

| Annuity Option | Annuity Amount INR |

| A | ₹ 57,375 every six month |

| B | ₹ 57,225 every six month |

| C | ₹ 56,852 every six month |

| D | ₹ 56,325 every six month |

| E | ₹ 55,575 every six month |

| F | ₹ 47,852 every six month |

| G | ₹ 44,625 every six month |

Scenario 3:

Age : 50 years – Single life

Purchase Price – ₹ 15 Lakh + GST

Annuity Mode – Quarterly

| Annuity Option | Annuity Amount ₹ |

| A | ₹28,407 every quarter |

| B | ₹28,330 every quarter |

| C | ₹28,146 every quarter |

| D | ₹27,880 every quarter |

| E | ₹27,546 every quarter |

| F | ₹23,680 every quarter |

| G | ₹22,107 every quarter |

Scenario 4:

Age : 50 years – Single life

Purchase Price – ₹ 15 Lakh + GST

Annuity Mode – Monthly

| Annuity Option | Annuity Amount ₹ |

| A | ₹ 9,400 per month |

| B | ₹ 9,374 per month |

| C | ₹ 9,327 per month |

| D | ₹ 9,237 per month |

| E | ₹ 9,126 per month |

| F | ₹ 7,836 per month |

| G | ₹ 7,339 per month |

Scenario 5:

The LIC Jeevan Akshay VII policy has been purchased by Mr. Kumar in March 2023 , a 50-year-old businessman jointly with his 45 year old wife. He has paid a purchase price of Rs. 15,00,000 plus GST for the policy. The policy offers various annuity options and rates to choose from, which are listed below.

Age : Primary Annuitant 50 years – Secondary Annuitant – 45 years

Purchase Price – ₹ 15 Lakh + GST

Annuity Mode – Yearly

| Annuity Option | Annuity Amount ₹ |

| A | ₹ 1,17,000 per year |

| B | ₹ 1,16,700 per year |

| C | ₹ 1,15,950 per year |

| D | ₹ 1,14,900 per year |

| E | ₹ 1,13,250 per year |

| F | ₹ 97,650 per year |

| G | ₹ 90,600 per year |

| H | ₹ 1,11,150 per year |

| I | ₹ 1,05,900 per year |

| J | ₹ 96,750 per year |

Frequently Asked Questions

The policyholder will receive fixed annuities that will be paid for the duration of their lifetime.

Yes, you can buy jointly with spouse, children etc. The other member should be your lineal ascendant / descendant.

The surrender option and loan facility are offered for certain annuity options within this plan, but they can only be availed after three months from the policy’s completion. Yes, you can surrender LIC Jeevan Akshay VII, but it may result in the loss of some benefits and a reduction in the surrender value. It’s important to carefully consider the implications of surrendering the policy before making a decision. You should contact your LIC agent or visit your nearest LIC branch to understand the surrender process and the exact amount that will be refunded to you upon surrendering the policy.

The interest rate on a loan taken against a LIC policy may vary depending on the type of policy and the specific terms and conditions of the loan. Generally, the interest rate on a LIC policy loan is around 9.50% per annum. However, it’s important to note that taking a loan against a life insurance policy may reduce the death benefit and can have other implications, so it’s advisable to carefully consider the decision before proceeding with a policy loan. You should contact your LIC agent or visit your nearest LIC branch to understand the exact terms and conditions of the loan and the applicable interest rate.

Jeevan Akshay is categorized as an immediate annuity plan, while Jeevan Shanti is a deferred annuity plan. With immediate annuity plans like Jeevan Akshay, you start receiving regular pension payments immediately after purchasing the plan. In contrast, deferred annuity plans like Jeevan Shanti provide regular pension payments only after the completion of the deferred period. Overall, both plans have their own unique features and benefits, and the choice between them depends on your individual financial goals and requirements. It’s advisable to consult with a financial advisor before making a decision.

I’ve been exploring annuity plans for my retirement, and this article has introduced me to LIC’s Jeevan Akshay Plan. The fact that it offers multiple annuity choices and guarantees regular income is quite appealing

Jeevan Akshay Plan is a valuable addition to LIC’s offerings, providing immediate financial security through various annuity options. The detailed explanation of the plan’s features in this blog is helpful

Retirement planning can be complex, but this article does a great job of breaking down the features of LIC’s Jeevan Akshay Plan. The flexibility and assurance of regular income are standout benefits

What is the reason behind the popularity of LIC’s Jeevan Akshay-VI plan among people?

The guaranteed regular income, flexible options, and tax benefits offered by the Jeevan Akshay plan have made it a popular choice among people who are looking for a secure and stable source of income after their retirement.

Annuities are a crucial part of retirement planning, and LIC’s Jeevan Akshay Plan offers an array of options to cater to different needs. The immediate and deferred annuity choices are commendable

Retirement planning is a critical aspect of financial well-being. LIC’s Jeevan Akshay Plan offers a diverse range of immediate annuity options, making it a strong contender for those looking for a secure retirement

Financial stability during retirement is essential, and LIC’s Jeevan Akshay Plan offers a variety of immediate annuity options. This article simplifies the plan’s features and helps individuals make informed choices

I’m impressed with LIC’s Jeevan Akshay Plan. The article provides a clear understanding of its features and benefits, making it easier for individuals like me to consider this plan for financial security during retirement

I’ve been researching annuity plans, and this article introduced me to LIC’s Jeevan Akshay Plan. The various annuity options and the flexibility to choose according to one’s needs are quite impressive

Immediate annuities are a smart way to secure regular income during retirement. The article’s explanation of LIC’s Jeevan Akshay Plan’s features and benefits is greatly appreciated

LIC’s Jeevan Akshay Plan is a brilliant choice for individuals seeking immediate annuity options. This blog provides a comprehensive overview of the plan, making it easier for those considering it for their financial future